- This event has passed.

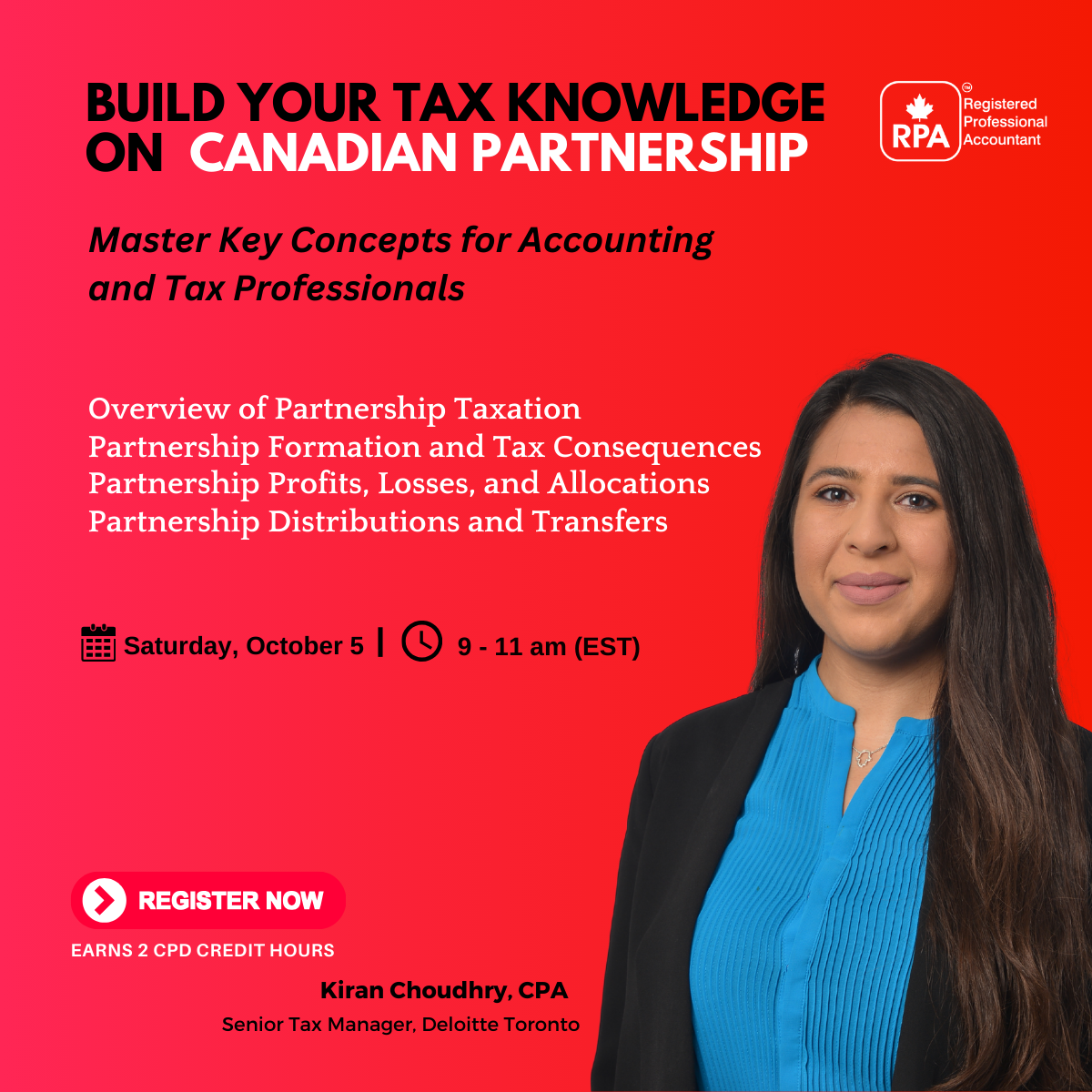

Build Your Tax Knowledge On: Canadian Partnership

Unlock the Essentials of Canadian Partnership Taxation

Attention accounting and tax professionals! Are you ready to master the fundamentals of partnership taxation?

What’s on the agenda?

Partnership Taxation Overview:

Get a comprehensive look at how partnerships are taxed as “pass-through” entities, and explore the strategic advantages and disadvantages of using partnerships in business structures.

Formation & Tax Consequences:

Understand the critical tax implications of forming a partnership, from capital contributions to determining a partner’s tax basis.

Profits, Losses & Allocations:

Dive into the essentials of allocating income and deductions among partners—vital for accurate tax reporting.

Distributions & Transfers: Learn about the tax impact of partnership distributions and the transfer of partnership interests, ensuring you can advise on withdrawals or sales with precision.

By the end of this seminar, you’ll be equipped to guide your clients through the nuances of partnership taxation, ensuring compliance and maximizing benefits.